Valuation of real estate

In the field of the evaluation of developed and undeveloped plots of land, in addition to market value appraisals and mortgage lending value appraisals, and appraisals for the determining of the fair market value and fair value, we also provide market value appraisals according to international standards.

- Market value within the meaning of section 194 BauGB (Federal Building Code)

- Mortgage lending value within the meaning of section 16 PfandBG (Mortgage Bond Act)

- Fair market value within the meaning of section 9 BeWG in conjunction with § 182 BeWG (Valuation Act)

- Fair value within the meaning of section 255 para. 4 HGB (German Commercial Code)

- Fair value within the meaning of IFRS 13, IAS 16, IAS 40

- Equity according to int. standards (IVSC, RICS, TEGoVA)

The main focus of our appraising activity is the valuation of developed and undeveloped plots and limited rights in rem in the meaning of § 1018 ff BGB for tax reasons. In addition to the valuation of residential and commercial properties, we also possess proven expertise in the valuation of special-purpose properties (including in the automotive, energy, agricultural, hospital and pharmaceutical, hotel and tourism industries).

The remuneration of experts in the field of the valuation of developed and undeveloped plots of land and related rights and encumbrances here takes place on the basis of a remuneration agreement as time-based or lump sum remuneration.

Market value appraisals in the meaning of § 194 BauGB

The valuation of developed and undeveloped plots of land and thus the remuneration of market value appraisals in the meaning of 194 BauGB is regulated in the Property Valuation Ordinance (ImmoWertV). In accordance with section 15 ff. ImmoWertV, a distinction is made between three standardised procedures according to which the value of a plot of land or of its constituent parts and/or related rights and encumbrances are determined: the German income approach, the asset value approach and the sales comparison approach. The market value according to section 194 BauGB is here defined as the price that would be achievable on the valuation cutoff date in usual business transactions taking into account the legal and actual conditions and the location of a plot of land or other object of valuation.

Typical reasons for the determining of the market value in the meaning of section 194 BauGB

- Dispute of communities of heirs within the meaning of section 2042 para.1 BGB

- Dispute of communities of accrued gain within the meaning of section 1363 BGB

- Transfer of land within the meaning of section 311b para.1 BGB

- Disposals relating to land within the meaning of section 1821 para.1 no.1 BGB

Farmhouse, County of Miesbach

Residential and officebuilding in Munich, Schwabing

Mortgage lending value appraisal within the meaning of section 16 PfandBG

The determining of the mortgage lending value of developed and undeveloped plots of land and thus the remuneration of mortgage lending value appraisals within the meaning of 16 PfandBG is regulated in the Mortgage Lending Value Ordinance (BelWertV). The Mortgage Lending Value (MLV) is the basis of the mortgage lending and is used by credit institutes and insurance companies as the collateral value. It differs from the market value in that it represents a period-based value rather one relating to a reporting date. The mortgage lending value, according to section 3 para. 1 BelWertV, is here the value and/or price of a property that would be expected to be achievable in normal business transactions regardless of temporary fluctuations caused by the economic situation or speculation.

Equity appraisal according to int. standards

As well as the property valuation in the German income, asset value and sales comparison approaches and thus the producing of market value appraisals according § 194 BauGB, we also determine the equity of properties according to int. standards (IVSC, RICS, TEGoVA). As well as residential properties, we also focus on commercial properties – especially upon industrial buildings, and catering and hotel properties, as well as office buildings.

Valuation of rights and encumbrances

Rights that establish a direct relationship between a person and an object are so-called rights in rem. A distinction is here made between ownership as the most far-reaching right in rem and limited rights in rem. These are, for example, easements such as e.g. rights of residence, security interests and exploitation rights, land charges, in rem pre-emption rights or building leases. In property valuation, they are to be taken into account in the determining of market value as value-influencing characteristics according to section 6 para. 2 ImmoWertV and/or to be themselves the object of the valuation and thus of the producing of value appraisals.

Apartment building, Munich, Harlaching

Technology park, County of München

Declaration of property value

In Germany, the tax valuation of assets is regulated by the Valuation Act (BewG). With property ownership, a distinction is made between landed property, agricultural and silvicultural assets and business assets. The fair market value according to § 9 BewG is here decisive for the valuation. The difference from the determining of market value according to section 194 BauGB in conjunction with sections 15 ff. ImmoWertV is that in the valuation of property according to section 182 BewG the choice of the method for the valuation of real estate is predefined.

Proof of the lower fair market value

To prevent overvaluing in the determining of the property value by the tax office, section 198 BewG envisages the possibility of certification of the lower fair market value. You can therefore count on our experience in tax-related property valuation when it comes to checking property values determined by the tax office.

Measurement and living space calculation

All too often, in our activities as valuers, we realise that declarations of division do not correspond with the actual state of affairs, effecting not only the additional and maintenance costs but also the market value. In addition to determining the value of estate in severalty and part ownership, we therefore also calculate areas of residential and commercial premises, produce measurement and partition plans for certificates of self-containment according to section 7 para. 4 in conjunction with section 3 para. 2 WEG, and check the approval and/or approvability of areas intended for continuous inhabitation.

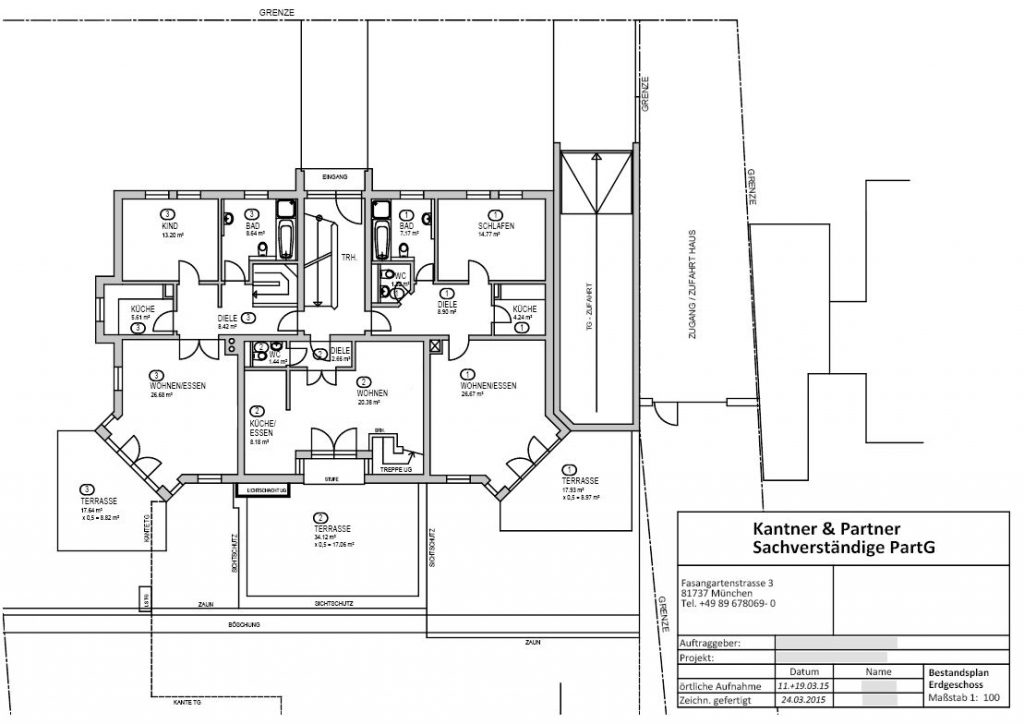

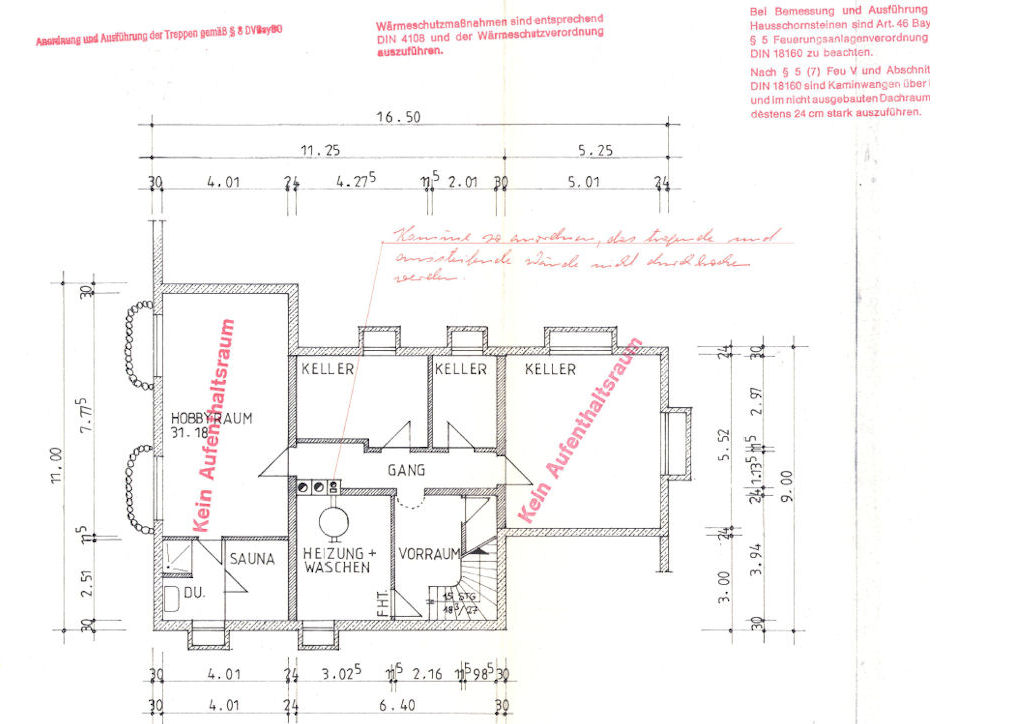

Measurement to correct a false subdivision of condominiums

Approved areas of a basement

TÜV-certified property valuers

Whether it be for collateralisation, for financial and/or taxation purposes or simply to determine assets – for determining the value of property, you can rely on our many years of experience in the valuation of residential and commercial properties, on our tested competence as TÜV-certified experts for the appraisal of developed and undeveloped real estate.